Retirement Planning Fundamentals Explained

Wiki Article

The Only Guide to Retirement Planning

Table of ContentsThe Of Retirement PlanningTop Guidelines Of Retirement PlanningThe Facts About Retirement Planning RevealedRumored Buzz on Retirement PlanningThe smart Trick of Retirement Planning That Nobody is DiscussingRetirement Planning Can Be Fun For Everyone

A 401(k) suit is also an extra inexpensive method to use a monetary incentive to your staff members, as your organization will be paying much less in payroll taxes than if you provided a standard raising or bonus, and the employee will also obtain even more of the cash due to the fact that they won't have to pay extra earnings tax - retirement planning.1. 5% may not appear like a lot, but simply an interest substances, so do costs. This cash is instantly subtracted from your account, so you may not instantly see that you might be saving countless bucks by relocating your properties to an affordable index fund, or switching companies to one with lower investment charges.

If you have particular pension where you can add with funds with tax obligations you have actually paid currently vs. paying taxes upon the withdrawal of the funds in retirement, you may intend to think concerning what would save you extra in tax obligation settlements over time. If you have specific much shorter term financial investment accounts, consider just how much cash you 'd spend there (and subsequently pay taxes on in the future) vs.

Some Known Details About Retirement Planning

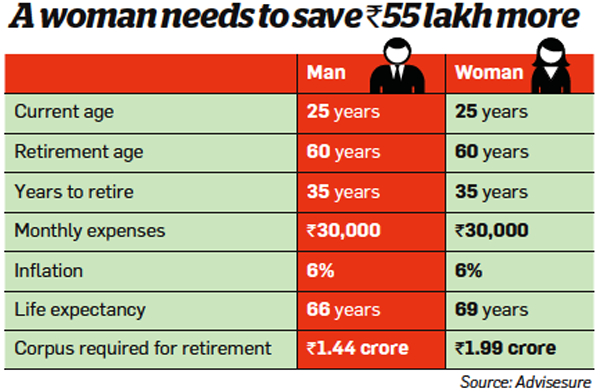

We think that instead of really feeling the pinch post-retirement, it's reasonable to begin saving early. What you simply need to do is to begin with an achievable saving, plan your financial investments and also with a long-term dedication. The way you want to spend your retirement entirely rely on the amount of cash you have actually conserved and also invested.

More About Retirement Planning

Fulfilling their heavy clinical costs and also various other demands together with personal family members demand is truly extremely difficult in today's era of high rising cost of living. retirement planning. It is advisable to begin with your retired life savings as very early as you are 20 years old and also solitary. The retirees posture a significant worry on their household who had actually not intended as well as conserved for their retired life.There's constantly a health and wellness issue connected with growing age. There might be a situation where you can not function any longer as well as the savings for retired life will certainly assist to guarantee that you are well cared of. So the big inquiry is that can you pay for the price of long-term care given that it can be very expensive as well as is included in the expense of your retired life.

Do you desire to keep working after your retired life? The people that are not really prepared site link for retired life often have to keep functioning to meet their household's demand throughout life.

Indicators on Retirement Planning You Need To Know

If you start late, it may occur that you have to compromise or change on your own with your pre-retirement and retirement lifestyle. Furthermore, the quantity that you need to save and also add each period will depend upon exactly how early you start saving. Starting with your retired life preparation in the twenties may seem too early for your retirement.

Beginning early will enable you to establish great retired life cost savings as well as planning routines and give you our website even more time to correct any kind of blunder as well as to determine any deficiency in achieving your goal - retirement planning.: Capture up on your Retired life Preparation in your 50s The retirement must be designed and executed as quickly as you begin working.

These monetary planners will certainly take into consideration different aspects to carry out retirement analysis which includes your revenue, costs, age, preferred retirement lifestyle and so on. Utilize the sweat of your golden years to give a color in your old days so that you depart the globe with the sensation of fulfillment and efficiency.

An Unbiased View of Retirement Planning

There is a common misconception amongst young workers, as well as it often seems something like, "I have plenty of time to plan for retirement. There's no demand to rush." Others believe, "As soon as I obtain my finances sorted, I'll start thinking of retired life." 1. If you wait for the "ideal" or "best" time, you'll never begin.

With these 2 concepts in mind, workers can be motivated to plan for retired life instantly. Neither their age nor their present funds need to come in the means Read Full Article of retired life preparation.

The Basic Principles Of Retirement Planning

A lot of us put things off occasionally even one of the most efficient individuals, obviously! When it comes to conserving for retired life, putting things off is not suggested. Early risers do not simply obtain the worm - they obtain five star buffets for virtually no effort. Allow's highlight the price of laziness with a tale of 3 imaginary pairs.For instance, based upon information from the Office for National Data they had 6,444 of disposable revenue per head in 1977. In 1982, they had 7,435 of disposable earnings per head. By 1987, they had 8,565 These couples are just the same age The vital distinction between them is, they didn't all start to conserve for their retired lives at specifically the exact same time.

They made a decision to conserve 175 per month (2,100 per year). 29 percent of their yearly income. They acquired low-cost common funds, putting 70 percent of their cash in supplies, 30 percent in bonds.

Report this wiki page